Trading Signals: A Complete Beginner's Guide

Introduction: Demystifying Trading Signals

If you've ever considered venturing into financial markets—whether it's forex, cryptocurrencies, stocks, or commodities—you've likely encountered the term "trading signals." For beginners, these signals can seem mysterious or complex, but they're actually straightforward tools designed to help traders make more informed decisions.

In today's fast-paced trading environment, where markets operate 24/7 and information flows constantly, trading signals have become increasingly popular. They offer guidance, structure, and potentially valuable insights that might otherwise require years of experience to develop.

This comprehensive guide will break down everything you need to know about trading signals in clear, simple terms. By the end, you'll understand what trading signals are, how they work, and most importantly, how to use them effectively as part of your trading journey.

Key Takeaway: Trading signals are simply recommendations for market actions (buy or sell) based on analysis of market conditions, designed to help traders identify potential opportunities.

What Exactly Are Trading Signals?

At their core, trading signals are suggestions or recommendations to enter or exit a trade on a specific asset at a particular time and price. Think of them as alerts that say, "Based on our analysis, now might be a good time to buy (or sell) this particular asset."

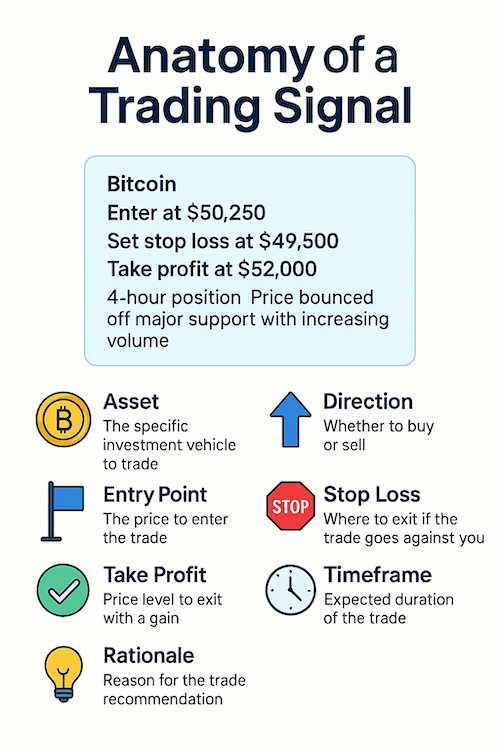

The Anatomy of a Complete Trading Signal

A comprehensive trading signal typically contains several essential components:

| Component | Description | Example |

|---|---|---|

| Asset/Market | The specific investment vehicle to trade | "EUR/USD" or "Bitcoin" or "Apple Stock" |

| Direction | Whether to buy (go long) or sell (go short) | "BUY" or "SELL" |

| Entry Point | The ideal price at which to execute the trade | "Enter at $50,250" |

| Stop Loss | Where to exit if the market moves against you | "Set stop loss at $49,500" |

| Take Profit | Price target(s) where you might consider exiting with profits | "Take profit at $52,000" |

| Timeframe | The expected duration of the trade | "Daily chart" or "4-hour position" |

| Rationale | The reasoning or analysis behind the signal | "Price bounced off major support with increasing volume" |

Key Takeaway: A quality trading signal should provide more than just "buy" or "sell"—it should include entry points, exit strategies, and ideally, the reasoning behind the recommendation.

Types of Trading Signals and How They're Generated

Trading signals come in various forms and are created using different methodologies. Understanding these differences is crucial for evaluating which signals might best suit your trading style and goals.

By Generation Method

1. Technical Analysis Signals

These signals are derived from chart patterns, indicators, and price action. They operate on the principle that historical price movements can indicate future price direction.

Example: A signal might be generated when a stock's 50-day moving average crosses above its 200-day moving average (known as a "Golden Cross"), suggesting a potential uptrend.

2. Fundamental Analysis Signals

These signals are based on economic data, company financials, news events, and other fundamental factors that might affect an asset's value.

Example: A signal to buy a currency might be triggered after a country reports stronger-than-expected GDP growth, suggesting potential currency appreciation.

3. Sentiment Analysis Signals

These rely on gauging market sentiment through measures like social media monitoring, positioning data, or surveys of market participants.

Example: A signal might suggest selling Bitcoin if sentiment analysis reveals extremely positive social media chatter, which might indicate an overbought condition.

By Delivery Method

1. Manual Signals

Created by human analysts who review markets and make recommendations based on their expertise and analysis.

Pros:

- Can adapt to changing market conditions

- May include nuanced insights

- Often include detailed explanations

Cons:

- Subject to human emotion and bias

- Potentially inconsistent

- Usually more expensive

2. Automated/Algorithmic Signals

Generated by computer programs or algorithms that analyze market data according to pre-defined rules.

Pros:

- Consistent and disciplined approach

- Removes emotional bias

- Can analyze vast amounts of data quickly

- Often more affordable

Cons:

- May not adapt well to changing market conditions

- Limited "intuition" about unusual events

- Quality highly dependent on the underlying algorithm

Key Takeaway: Different types of signals suit different trading styles. Technical signals tend to work better for short-term trading, while fundamental signals often align better with longer-term investments.

How to Interpret and Use Trading Signals Effectively

Receiving a trading signal is just the beginning. Knowing how to interpret and apply it correctly is what separates successful signal users from those who struggle.

Step-by-Step Process for Using Trading Signals

1. Understand the Signal Components

- Identify all parts of the signal (asset, direction, entry, exits, etc.)

- Note the timeframe and expected duration of the trade

2. Evaluate Signal Quality

- Check if the signal aligns with the current market conditions

- Verify that all necessary information is provided

- Consider the track record of the signal provider

3. Integrate with Your Trading Plan

- Determine if the signal fits your risk tolerance

- Calculate position size based on your risk management rules

- Ensure the signal works with your overall strategy

4. Execute Properly

- Place your trade with the correct parameters

- Set stop losses and take profits as recommended (or adjusted to your risk tolerance)

- Avoid emotional adjustments to the signal parameters

5. Monitor and Manage

- Track the trade's progress

- Follow the exit strategy as planned

- Document the results for future reference

Common Mistakes When Using Trading Signals

❌ Following Signals Blindly

Without understanding the logic behind a signal, you can't adapt when market conditions change.

❌ Ignoring Risk Management

Even the best signals will sometimes be wrong. Always use stop losses and proper position sizing.

❌ Cherry-Picking Signals

Selecting only the signals that confirm your existing bias can lead to poor results.

❌ Overtrading

Using too many signal sources or taking every signal can lead to excessive trading and increased costs.

Key Takeaway: Trading signals should complement your trading strategy, not replace critical thinking. The best signal users understand what they're following and why.

Evaluating Signal Quality: How to Spot Good Trading Signals

Not all trading signals are created equal. Here's how to evaluate whether a signal source is worth your attention:

The Quality Checklist for Trading Signals

✅ Transparency in Track Record

Good signal providers maintain and share their historical performance data.

✅ Clear Methodology

The provider should explain their approach to generating signals.

✅ Complete Information

Quality signals include all necessary components (entry, exit, rationale).

✅ Reasonable Win Rate Claims

Be wary of providers claiming unrealistic success rates (like 90%+).

✅ Consistent Format and Delivery

Signals should be delivered in a consistent, clear format.

Red Flags: Warning Signs of Poor-Quality Signals

🚩 Guaranteed Returns

No legitimate signal provider can guarantee profits.

🚩 No Risk Management Guidance

Signals without stop loss recommendations show a lack of risk awareness.

🚩 Excessive Marketing Language

Beware of providers using hyped-up language promising wealth or financial freedom.

🚩 Pressure to Act Quickly

Quality signals don't rely on artificial urgency.

🚩 No Trial or Sample Signals

Reputable providers typically offer some free signals or a trial period.

Examples

Example of a Poor Signal:

"BUY GOLD NOW!!! Price about to EXPLODE! Don't miss this once-in-a-lifetime opportunity!!!"

Example of a Quality Signal:

"Gold (XAUUSD): BUY

Entry: $1,876-1,880

Stop Loss: $1,865 (below recent support)

Take Profit 1: $1,895

Take Profit 2: $1,910

Timeframe: 4-hour chart

Rationale: Price formed a double bottom pattern at key support with RSI divergence indicating potential reversal. Dollar weakness following yesterday's Fed comments provides fundamental support."

Key Takeaway: Quality signals provide complete information and reasonable expectations, while poor signals rely on hype and urgency.

The Pros and Cons of Using Trading Signals

Like any trading tool, signals have both advantages and limitations. Understanding these can help you use them appropriately.

Advantages of Trading Signals

✅ Time Efficiency

Signals can save considerable research and analysis time.

✅ Learning Opportunity

Following quality signals with explanations can help develop your own analytical skills.

✅ Emotional Discipline

Well-structured signals can help remove emotional decision-making.

✅ Access to Expertise

Signals can provide insights from experienced analysts you might not otherwise have.

Limitations and Challenges

❌ Dependency Risk

Over-reliance on signals may prevent developing your own skills.

❌ Delayed Transmission

Even fast signal delivery may sometimes be too late for optimal entry.

❌ One-Size-Fits-All Problem

Signals aren't customized to your specific risk tolerance or account size.

❌ Variable Quality

The trading signals marketplace includes both excellent and poor-quality providers.

Key Takeaway: Trading signals work best as a supplement to your own knowledge and strategy, not as a complete replacement for learning how to trade.

How to Incorporate Signals into Your Trading Education

For beginners, trading signals can be valuable educational tools when used correctly:

Learning from Signals

1. Study the Rationale

When a signal includes analysis, try to understand the reasoning rather than just following the recommendation.

2. Paper Trade First

Practice following signals with a demo account before risking real money.

3. Compare Signal and Outcome

After a signal plays out, analyze what happened compared to what was predicted.

4. Learn the Patterns

Start noticing similarities between successful signals to develop pattern recognition skills.

5. Gradually Develop Independence

As you learn, try identifying potential trades before checking your signal provider.

Key Takeaway: Use signals as training wheels that eventually lead to developing your own analysis skills.

Getting Started: A Beginner's Action Plan

If you're new to trading signals, here's a structured approach to incorporating them into your trading:

Your 5-Step Action Plan

1. Education First

Learn the basics of the market you want to trade before following any signals.

2. Research Providers

Use the quality checklist above to evaluate potential signal providers.

3. Start with Free Trials

Test several providers without financial commitment before choosing one.

4. Paper Trade Initial Signals

Practice with a demo account for at least 2-4 weeks.

5. Start Small

When moving to real trading, use minimal position sizes until you've verified the signals work for you.

Questions to Ask Before Following Any Signal Provider

Before committing to a signal service, ask these critical questions:

- What is their verified track record?

- How transparent are they about losses?

- What markets and timeframes do they specialize in?

- How are their signals generated?

- What happens when market conditions change dramatically?

- How responsive is their customer support?

- Can they provide testimonials from long-term users?

- Do they offer educational content alongside signals?

Key Takeaway: The best signal provider for you aligns with your trading style, timeframe, and goals.

Conclusion: Trading Signals as Tools, Not Magic Solutions

Trading signals can be valuable components in a trader's toolkit, providing structure, insights, and potentially profitable opportunities. However, they're most effective when approached with realistic expectations and integrated into a broader trading education.

Remember that even the best signals cannot guarantee profits, and developing your own knowledge remains essential for long-term trading success. Use signals as guides and learning tools, not as shortcuts or substitutes for understanding markets.

By following the guidelines in this article, you'll be better equipped to find quality signals, interpret them correctly, and use them as stepping stones toward becoming a more informed and confident trader.

Final Key Takeaway: The most successful signal users are those who eventually learn to generate their own internal signals, using external providers as supplements rather than primary decision-makers.

Frequently Asked Questions About Trading Signals

Q: How much do trading signals typically cost?

A: Prices vary widely from free signals to premium services costing hundreds of dollars monthly. Higher prices don't always indicate better quality. Start with free trials when available.

Q: Can I make money just by following trading signals?

A: While good signals can improve your trading, consistent profitability requires proper risk management, discipline, and market knowledge. No signal service guarantees profits.

Q: How do I know if a signal provider is legitimate?

A: Look for transparent track records, reasonable claims, clear methodologies, and reviews from long-term users. Avoid providers promising guaranteed returns or using high-pressure sales tactics.

Q: Should I follow multiple signal providers?

A: For beginners, it's better to focus on one or two reputable providers for your chosen market. Too many signals can lead to confusion and overtrading.

Q: Do professional traders use signals?

A: Many professionals use some form of signals or alerts, though they typically incorporate them as one input among many and often generate their own signals through analysis.